It’s a new year, which brings about new rules and regulations. The Financial Crimes Enforcement Network is part of the U.S. Treasury and was designed to “to safeguard the financial system from illicit use.” As a result, all of us business owners are being asked to provide our beneficial ownership information, or BOI report. Is it a big deal? Yes. We will show you why you should complete your BOI reporting requirements now.

1. What are BOI Reporting Requirements?

As of January 1, 2024, the Financial Crimes Enforcement Network was accepting BOI reports. The regulation began in 2021 for the purpose of monitoring businesses and those doing business in the United States to disclose who owns the business and/or controls them. An existing business has one year to file. A new business must file their BOI within the first 90 days of their registration or creation. Any business started after January 1, 2025 will have 30 days to file their BOI. The good news is you don’t need to pay an attorney or even pay a fee to file your BOI, as of the printing of this blog.

Did you know? There were over 33 million small businesses operating in the United States at the end of 2022? Source: Forbes

2. What Happens if I Don’t File a BOI Report?

Someone who willfully violates the BOI reporting requirements can be fined up to $500 for each day of the violation as well as criminal penalties an additional fine of up to $10,000 and of up to 2 years in jail. This includes deliberately failing to file a beneficial ownership information report, filing false information, or failing to update or correct previously reported information.

3. Is Anyone Exempt From BOI Reporting?

Yes, there are over 20 exemptions from having to file a BOI. However, they include businesses such as non-profit organizations, banks, credit unions, a “large operating company,” and a few others. However, if you are in doubt, you should file a BOI. There are also five difference exemptions for who qualifies as a “beneficial owner.”

What Do I Need to File a BOI Report?

The BOI report requirements include but are not limited to:

- Legal name.

- Any and all trade names, such as “doing business as” or “trading as.”

- Current street address of your principal place of business if you are in the United States. No P.O. Boxes are accepted.

- Any tribal jurisdiction of formation or registration.

- Your taxpayer identification number or TIN and/or employer identification number or EIN.

The “beneficial owner” and “company applicants” will need to report their legal name, date of birth, address, and identifying number from a driver’s license, passport, or other accepted official document.

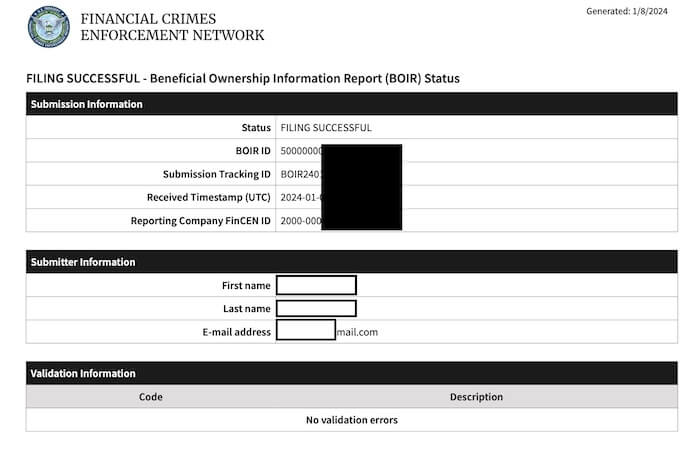

Once complete, you may receive an email with a FinCen ID that can help you in the future as shown above.

To read more about the Financial Crimes Enforcement Network, click here for their official page.

We Can Complete Your BOI Reporting Requirements Now

Please note: We are not associated in any way with the U.S. Treasury or Financial Crimes Enforcement Network. However, we can help you compete your BOI reporting requirements now. Simply contact our team or call us at 281-894-6494 to let us do the work for your business.