All of you who have S corporations, LLCs, or any other registered business need to know about this issue ASAP. We recently had a bookkeeping and accounting client succumb to this ploy that ended up costing him thousands. How could he have avoided this? One simple form.

1. The Ploy

Unfortunately, many unruly types exist in our land and are looking to rip off any one they can. They perused the registrations of many types of businesses all across Texas. They then compared the registered address with the current address. As with many businesses, addresses change from time to time, but the registered address did not change in this case. Dishonest people know this. They then file a bogus lawsuit with the business at its registered address, hoping you never get the summons. Without the summons, you don’t know to appear in court. You lose the judgement by default – as happened in this case.

2. How to Avoid This

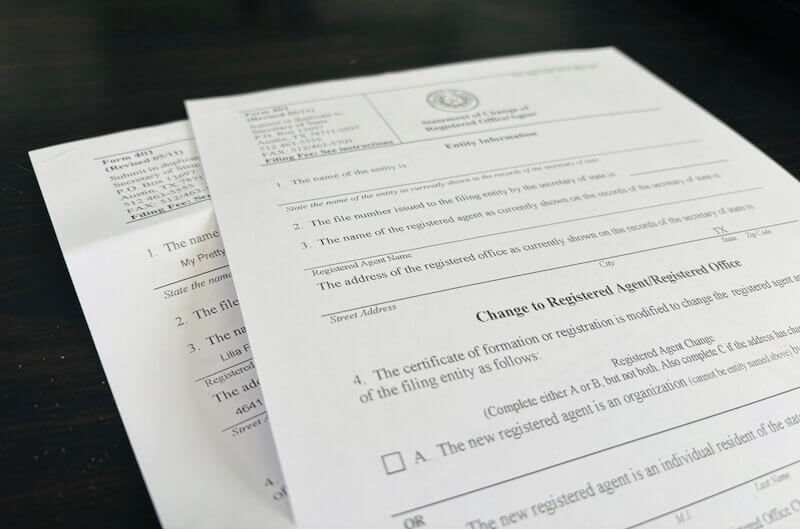

The best way to avoid this type of issue is to change your address every time you move your business. Each state has its own way of doing so. In Texas, we use the Form 401 – Change of Registered Agent/Office from the Secretary of State of Texas. You may click here to get the form.

Form 401 states your office address must be located at a street address where goods and/or services are provided during normal business hours. Your registered office is not required to be your principal place of business, but it cannot be just a mailbox service or telephone answering service. Non-profit businesses may need to file additional forms.

Did you know? The Small Business Administration shows that small businesses are sued at a rate of 36% to 53% every year? Source: Business DIT

3. How to Fill Out Form 401

You will need to have several key pieces of data to fill out the form:

- Name of the Entity.

- File number issued to Secretary of State of Texas.

- New and old address of the business.

- Name of new registrant or organization – if applicable.

- Signature of authorized person.

- A filing fee also applies.

The form must then be duplicated and sent to the proper authorities. However, all official correspondence must go to your official address upon successful filing.

How This One Form Can Save You Thousands With a Bookkeeper

Last of all, one of the best ways to avoid this is with the help of an experienced bookkeeper or accountant. If you live in Texas and need an expert to help you properly fill out and file this form, contact us.