So you own a small business and have tons of regular expenses. What do you do when you have an unforeseen expense in the form of a breakdown in your machinery? Below we will give you a guide to small business equipment financing.

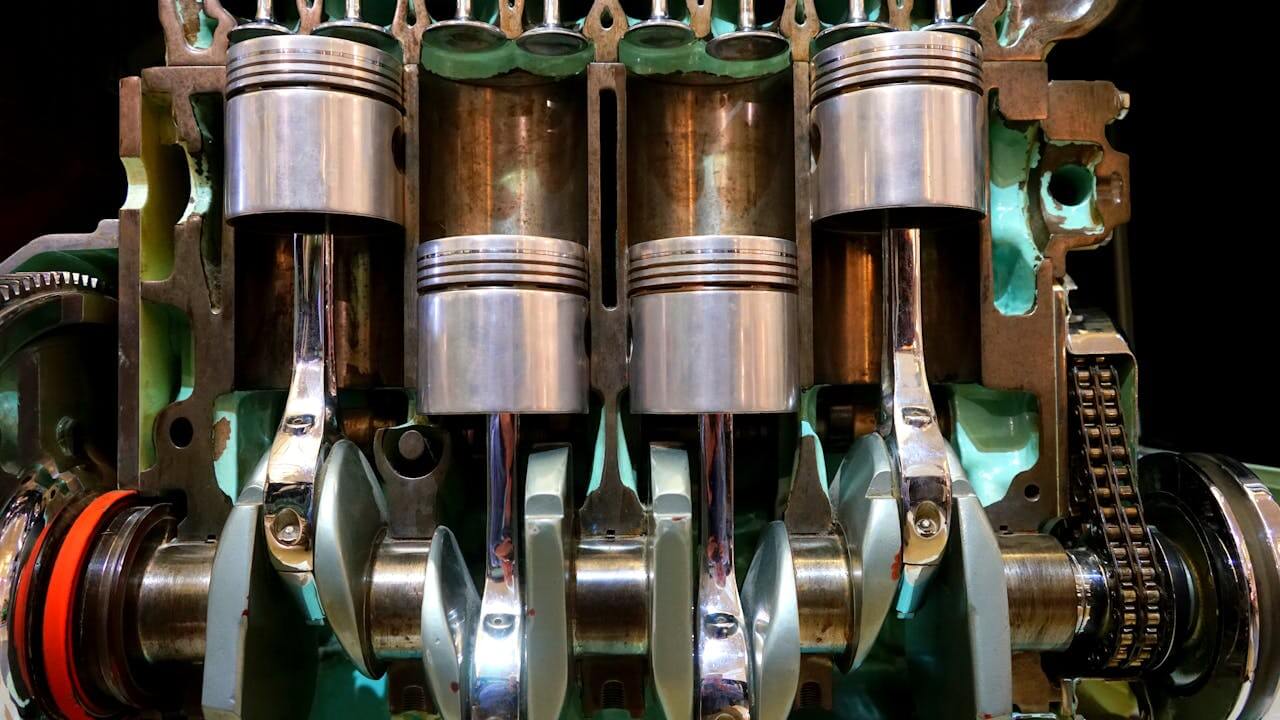

1. Your Equipment is Vital to Your Business

Your business relies on its machinery to keep product going out and business coming in. This is especially true for industrial businesses such as in manufacturing, oil and gas, and even a t-shirt printing company. The first step is always knowing your equipment, how to maintain it, and how to troubleshoot it. Consult your owners manual for quick solutions first when a breakdown happens.

Did you know? The Maintenance Market across the entire globe will reach a of $701.3 Billion by the year 2026? Source: Go Codes

2. Check Your Warranty

Luckily, most heavy equipment and machinery come with a warranty that can cover all sorts of breakdowns – or even slowdowns – and across a certain number of years or usage. You should have all this information handy in both print and digital form, as well as several backups. Contact your OEM right away if your equipment is under warranty to get a replacement and/or repair as soon as possible.

3. Take Out a Loan

What do you do if your equipment is out of warranty and a repair or replacement just isn’t in the budget? There are banks out there who will allow you to take out a loan for this equipment. There are certain conditions in general, such as:

- A minimum business credit score of 600 or other.

- Minimum time in business of usually 6 or 12 months.

- Annual revenue with a certain minimum usually depending on the amount of the loan.

- Some business, personal, or even lien guarantees may be required.

Check out this list from Nerdwallet on Best Equipment Financing for 2024 to see if this option is right for you.

Did you know? Unplanned downtime as a result of equipment breakdown or similar has costed the manufacturing industry approximately $50 Billion each year? Source: Go Codes

4. Consider Equipment Insurance

Do you experience equipment breakdowns often? You may want to consider purchasing equipment insurance. It works a bit like an extended warranty where you are covered for certain repairs within a certain period and may be charged a deductible. You may add it to your current small business insurance to cover everything from cooking equipment to manufacturing machinery to your HVAC system. Damages include failures, electrical surges, burnouts, and more.

5. Be Sure to Write it Off Your Taxes

Don’t forget to write off the costs of repairing and replacing your equipment at the end of each year’s tax return. You may also be able to deduct the cost of any loan, interest, and equipment insurance. Be sure your bookkeeper helps you file all correct forms properly, as each circumstance is different.

More Small Business Equipment Financing & Other Tips

Has your small business experienced some sort of loss and you need expert help? Feel free to contact us or call 281-894-6494 to schedule an appointment to learn how we can help.